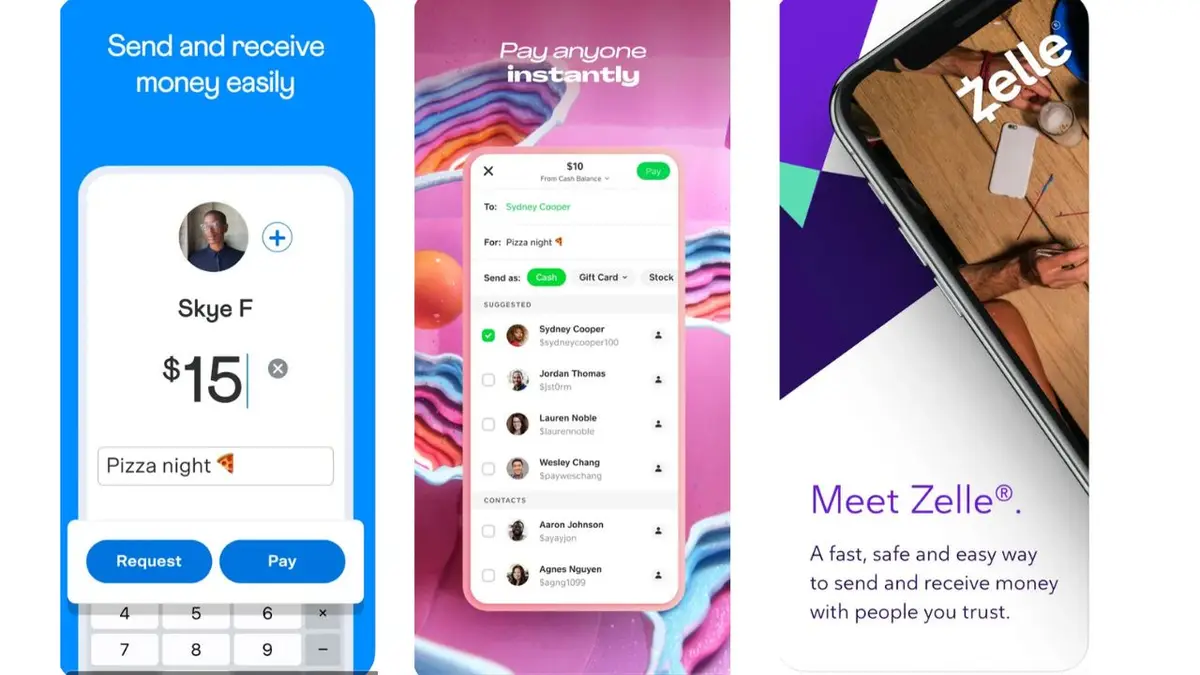

In recent times, payment apps like Venmo, Zelle, and Cash App have become increasingly susceptible to scams, endangering users’ savings. Here’s how to protect yourself from these digital pitfalls:

Key Highlights:

- Scammers are targeting users of apps like Venmo, Zelle, and Cash App.

- Common scams include fake payment invoices, overpayment, phishing attacks, and more.

- Protecting yourself involves being vigilant, verifying transactions, and using security features.

Understanding the Threat

The convenience of mobile payment apps also brings risks. Scammers exploit these platforms to conduct various fraudulent activities. The Federal Trade Commission (FTC) and other consumer protection agencies have issued warnings about these growing threats.

Types of Scams Encountered

- Fake Payment Invoices: Scammers may send emails that look like official Venmo payment requests but are actually fraudulent.

- Overpayment Scams: Fraudsters overpay for an item and ask for a refund of the excess, only for you to find out later that the initial payment was fake.

- Phishing Attacks: Emails or texts from scammers impersonating Venmo or other apps can trick you into revealing personal information.

- Suspicious Activity Scams: Scammers impersonating banks, claiming suspicious activity on your account, and urging you to transfer funds, which actually go to the scammer.

How to Protect Yourself

- Transaction Verification: Always verify the legitimacy of any transaction. Be wary of overpayments and check the authenticity of payment requests.

- Secure Communication: Do not respond to or click on links in unsolicited emails or texts claiming to be from these payment apps.

- Use Official Channels: If you suspect fraudulent activity, contact the payment app’s customer service directly.

- Privacy Settings: Utilize security settings like two-factor authentication to safeguard your account.

- Awareness is Key: Stay informed about the latest scams and educate yourself on recognizing and avoiding them.

Reporting Scams

If you fall victim to a scam, it’s crucial to report it immediately to the respective payment app’s customer service and the FTC.

In Summary

The rise of scams in payment apps like Venmo, Zelle, and Cash App calls for heightened vigilance and proactive measures. By understanding the types of scams and employing strategies like transaction verification, secure communication, and using privacy settings, you can protect your savings from these digital threats.